When you pick up your prescription, you might be shocked by the price tag-even if you have insurance. That’s because most plans don’t cover everything. You’re expected to pay part of the cost yourself. This is called cost sharing. And it comes in three main forms: deductibles, copays, and coinsurance. Understanding how these work can save you hundreds-or even thousands-of dollars a year on medications.

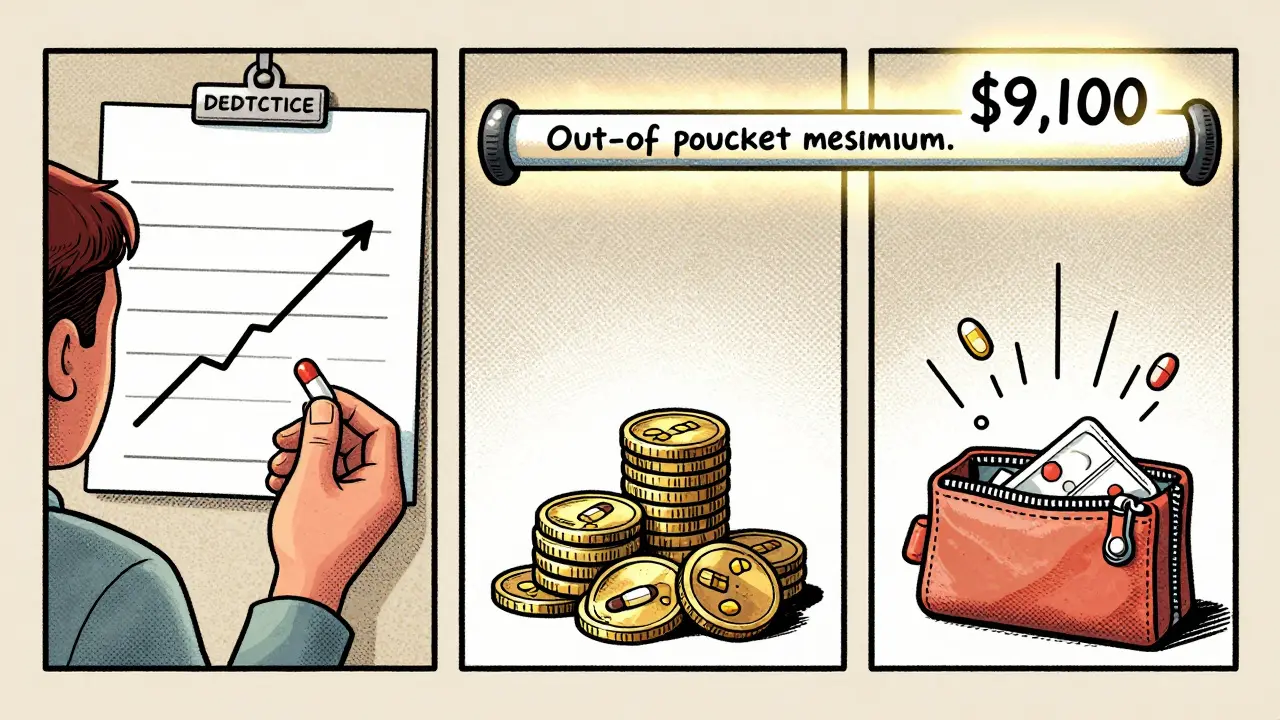

What Is a Deductible?

Your deductible is the amount you pay out of pocket for covered services before your insurance starts helping. For prescriptions, that means you pay the full price of your meds until you hit that number. If your plan has a $1,500 deductible, you’ll pay $1,500 in total for doctor visits, lab tests, and medications before your insurance begins to share the cost.Some plans have separate deductibles for medical and pharmacy costs. Others combine them. Check your Summary of Benefits and Coverage (SBC) document-it’s required by law and must clearly show how your deductible works for prescriptions.

High-deductible health plans (HDHPs) are common. In 2023, the average individual deductible for these plans was around $5,000. They come with lower monthly premiums, but you pay more upfront when you need care. If you’re healthy and rarely use meds, this might make sense. But if you take daily medication for diabetes, high blood pressure, or asthma, you could hit your deductible quickly-and still pay full price until you do.

What Is a Copay?

A copay is a fixed amount you pay at the pharmacy counter, no matter what the drug costs. It’s like a flat fee. For example, your plan might charge $10 for generic drugs, $30 for brand-name, and $50 for specialty medications. You pay that amount every time you refill, even if the drug costs $300.Here’s the catch: copays often don’t count toward your deductible. But they do count toward your out-of-pocket maximum. That’s important. Once you hit that limit, your insurance pays 100% of covered prescriptions for the rest of the year.

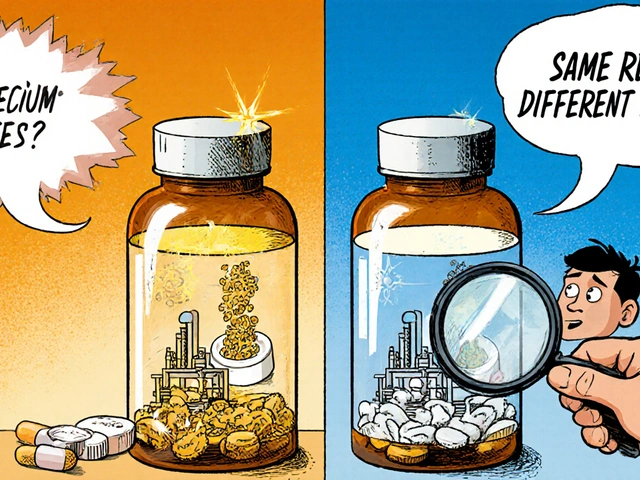

Some plans offer $0 copays for preventive meds or generics. Others have tiered systems. Tier 1: $5 generic. Tier 2: $25 preferred brand. Tier 3: $50 non-preferred brand. Tier 4: $100+ specialty. The higher the tier, the more you pay. Always check your plan’s formulary-the list of covered drugs and their tiers-before filling a new prescription.

What Is Coinsurance?

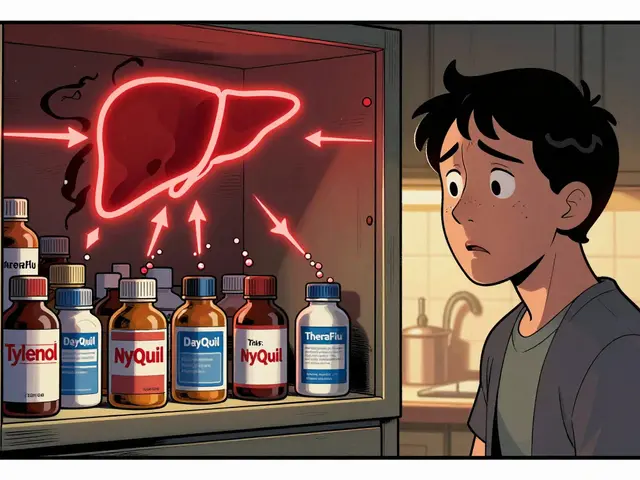

Coinsurance kicks in after you meet your deductible. Instead of a fixed fee, you pay a percentage of the drug’s cost. For example, if your coinsurance is 20%, and your medication costs $100, you pay $20. Your insurance pays the other $80.This is where things get tricky. Coinsurance percentages vary by drug tier. You might pay 20% for generics but 40% for specialty drugs. And if you go out-of-network? Your coinsurance could jump to 60% or more.

Let’s say you take a monthly specialty drug that costs $2,000. After your deductible, your 30% coinsurance means you pay $600 per month. That’s $7,200 a year-just for one medication. Without knowing coinsurance rules, you could be blindsided by these costs.

Deductible vs. Copay vs. Coinsurance: The Real Difference

It’s easy to mix these up. Here’s how they actually work together:- Deductible: You pay 100% until you hit the number. Applies to all covered services.

- Copay: Fixed fee per prescription. Often paid even before deductible is met.

- Coinsurance: Percentage you pay after deductible. Changes based on drug cost.

Some plans use copays for prescriptions instead of coinsurance. Others use coinsurance for specialty meds and copays for generics. No two plans are the same. That’s why reading your SBC isn’t optional-it’s essential.

Out-of-Pocket Maximum: The Safety Net

Your out-of-pocket maximum is the most you’ll pay in a year for covered services. In 2023, the ACA set the cap at $9,100 for individuals and $18,200 for families. Once you hit that number, your insurance pays 100% of all covered prescriptions for the rest of the year.Here’s the key: only what you pay for deductibles, copays, and coinsurance counts toward this cap. Premiums don’t. Neither do non-covered drugs.

People often think their out-of-pocket max includes their monthly premium. It doesn’t. And many don’t realize that specialty drugs can eat up that cap fast. A single cancer drug with 40% coinsurance can cost $10,000 a year. If you’re on multiple meds, you could hit the max by June.

How to Save Money on Medications

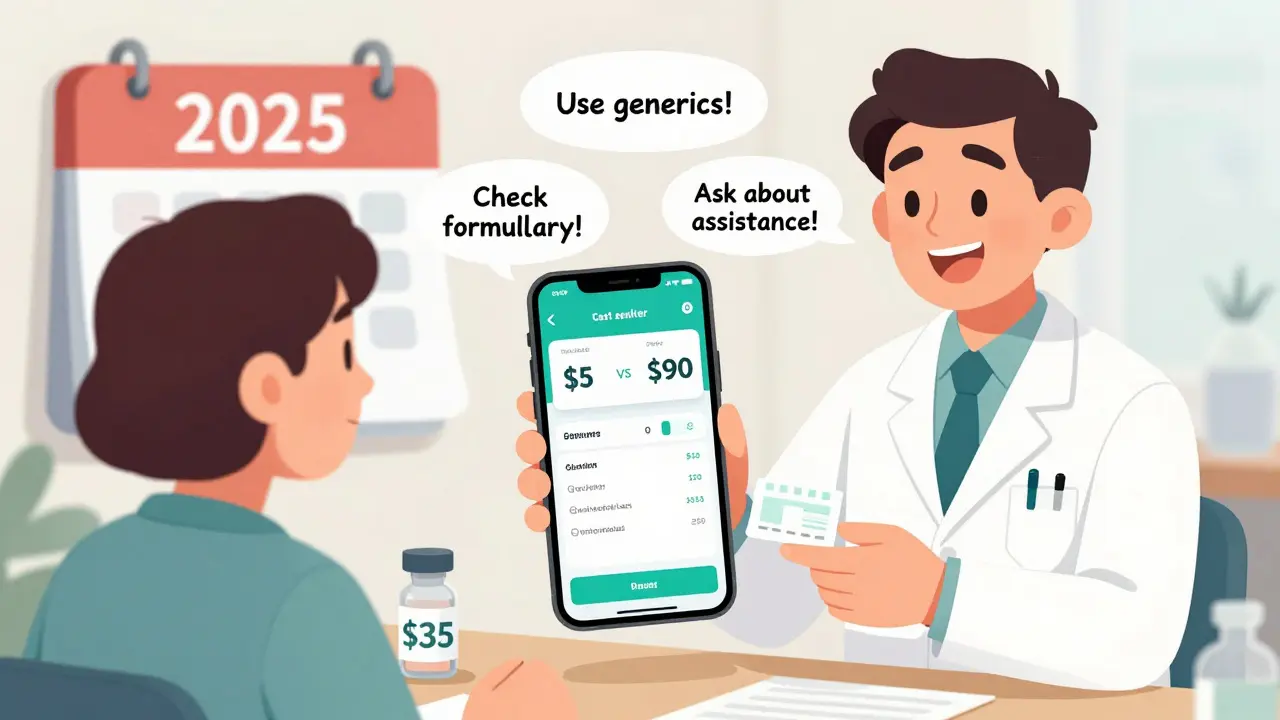

You don’t have to just accept what your plan charges. Here’s what actually works:- Use generic drugs. They’re chemically identical to brand-name drugs but cost 80% less. Ask your pharmacist or doctor if a generic is available.

- Check your plan’s formulary. If your drug isn’t on the list-or is in the highest tier-ask if there’s a similar, lower-cost alternative.

- Use mail-order pharmacies. Many plans offer 90-day supplies at lower copays. That’s two refills for the price of one.

- Use cost estimator tools. Most insurers have online tools that show real-time prices at local pharmacies. One study found people who used these saved an average of 22% on out-of-pocket costs.

- Ask about patient assistance programs. Drug makers often offer discounts or free meds for low-income patients. Websites like NeedyMeds.org list them.

- Verify in-network pharmacies. Going out-of-network can double your coinsurance. Always check before you fill.

What’s Changed in 2025?

The Inflation Reduction Act capped insulin at $35 per month for Medicare beneficiaries-and that’s now standard across most plans. Some private insurers have followed suit. If you use insulin, you’re likely paying far less than before.Also, new transparency rules require insurers to show you your estimated out-of-pocket cost before you fill a prescription. This is still rolling out, but if your pharmacy app or insurer’s website shows a price estimate, trust it. It’s legally required to be accurate.

By 2025, more plans will use “value-based insurance design.” That means lower cost-sharing for high-value meds (like those for diabetes or heart disease) and higher cost-sharing for low-value ones (like certain antibiotics or overused painkillers). It’s designed to encourage smarter use of meds-not just cheaper ones.

Common Mistakes People Make

- Thinking their copay is their total cost. It’s not. Coinsurance can add hundreds more after deductible.

- Assuming all meds are covered. Many plans exclude weight-loss drugs, fertility meds, or certain mental health prescriptions.

- Not checking if their pharmacy is in-network. Out-of-network pharmacies can charge 3x more.

- Ignoring the out-of-pocket max. If you’re on expensive meds, you’ll hit it-and then everything becomes free.

One patient in Perth told me she paid $1,200 for her monthly rheumatoid arthritis drug because she didn’t know her coinsurance was 40%. She didn’t realize she’d hit her out-of-pocket max by October. After that, her next 12 refills cost her $0. She just didn’t know to ask.

What to Do Right Now

1. Log into your insurer’s website or app. Find your Summary of Benefits and Coverage (SBC). Look for “Pharmacy Benefits.” 2. Find your deductible, copay tiers, and coinsurance rates for prescriptions. 3. Check if your meds are on the formulary and what tier they’re in. 4. Use the cost estimator tool to compare prices at nearby pharmacies. 5. Call your insurer and ask: “What’s my out-of-pocket maximum for prescriptions this year?” 6. Ask your pharmacist: “Is there a lower-cost alternative?”Knowing how your cost sharing works isn’t just helpful-it’s life-changing. You’re not being charged unfairly. You’re just being charged without knowing why. Once you understand the system, you can take control.

Do copays count toward my deductible?

Usually not. Copays are separate from your deductible. You pay them even before you meet your deductible. But they do count toward your out-of-pocket maximum. Always check your plan’s rules-some plans combine them, but most don’t.

What happens if I don’t meet my deductible?

You pay the full price for your prescriptions until you reach the deductible amount. For example, if your deductible is $2,000 and you’ve only spent $800 so far, you pay 100% of the cost for every medication. After you hit $2,000, coinsurance kicks in.

Can I avoid coinsurance on expensive medications?

Sometimes. Many drug manufacturers offer patient assistance programs that cover coinsurance for high-cost meds. Also, some plans have special tiers or prior authorization rules that reduce your share. Talk to your pharmacist or call your insurer’s pharmacy help line. You might qualify for help.

Are preventive medications covered before I meet my deductible?

Yes. Under the Affordable Care Act, most preventive services-including vaccines, cancer screenings, and certain blood pressure or cholesterol meds-are covered at 100% even before you meet your deductible. Check your plan’s list of preventive services to see what’s included.

Why does my prescription cost more at one pharmacy than another?

Because pharmacies set their own prices for the same drug. Insurance companies negotiate different rates with each pharmacy. A drug that costs $40 at Walmart might cost $90 at a small local pharmacy-even if both are in-network. Always use your insurer’s cost estimator tool to find the lowest price before filling.

What if I can’t afford my copay or coinsurance?

Don’t skip your meds. Ask your pharmacist about discount programs, patient assistance, or payment plans. Many drug makers offer free or low-cost options if you qualify based on income. You can also call 211 or visit NeedyMeds.org to find help. Skipping meds because of cost can lead to bigger health problems-and bigger bills later.

Next Steps

If you’re on chronic medication, take 10 minutes today to check your plan’s details. You might be paying more than you need to. If you’re not sure where to start, call your insurer’s pharmacy benefits line. Ask them to walk you through your cost-sharing structure. Most will do it for free.And remember: just because your insurance covers a drug doesn’t mean it’s affordable. Cost sharing is designed to make you think before you use care. Use that power wisely. Know your numbers. Ask questions. Save money. Stay healthy.

10 Comments

This whole system is rigged. I pay $800 a month for my insulin and they call it 'affordable'-like I'm supposed to be grateful? My dad died because he skipped doses to save money. This isn't healthcare, it's a pyramid scheme with pill bottles.

deductibles are just a way to make people give up on meds. i had to pick between my asthma inhaler and groceries last year. no one talks about how this hurts real people. just numbers and 'financial responsibility' like its a game.

It is imperative to note, with rigorous adherence to regulatory frameworks and actuarial principles, that cost-sharing mechanisms are not merely fiscal instruments-they are behavioral nudges designed to mitigate moral hazard within the healthcare utilization ecosystem. The structural integrity of such models is predicated upon risk-pooling efficiency and actuarial fairness, thereby ensuring long-term solvency of the insurance mechanism itself.

Stop complaining. If you can't afford your meds, maybe you shouldn't have chosen a high-deductible plan. I work two jobs and I pay my share-no handouts. This isn't charity, it's insurance. Get your act together.

I used to think coinsurance was just a number on a bill until my sister got diagnosed with MS. She paid $1,200 a month for her drug until she hit her out-of-pocket max in August. Then, suddenly, it was free. She didn't know until she called the pharmacy. That moment changed everything. If you're on chronic meds, call your insurer. Ask. Ask again. Don't wait until you're broke.

Thank you for this detailed breakdown. In India, we have no such transparency-medication pricing is a black box. I hope these reforms spread globally. Knowledge is power, and you've given people a flashlight in a dark room.

People need to stop expecting everything to be free. I’ve never missed a dose because I couldn’t afford it-I just chose a better plan. If you’re poor, don’t blame the system. Blame yourself for not planning. Also, generics exist. Use them. It’s not that hard.

OH MY GOD. I just realized I’ve been paying $900/month for my RA drug for 2 YEARS because I thought my copay was it. I didn’t even know coinsurance existed. I’m crying. I’m furious. I’m calling my insurer RIGHT NOW. And I’m telling everyone I know. This is a goddamn scam and I’m done being quiet.

Wow. Just... wow. I can't believe people are still surprised by this. You get what you pay for. If you want low premiums, you get high out-of-pocket. Simple math. But no-people want it all: cheap premiums, zero copays, free drugs, and a gold-plated healthcare system. Wake up. This isn't a Netflix subscription.

OMG I just checked my app and my insulin is $35 now?? 😭 I’ve been paying $120 for 3 years… I’m so mad I didn’t know. Thanks for this. 🙏💖