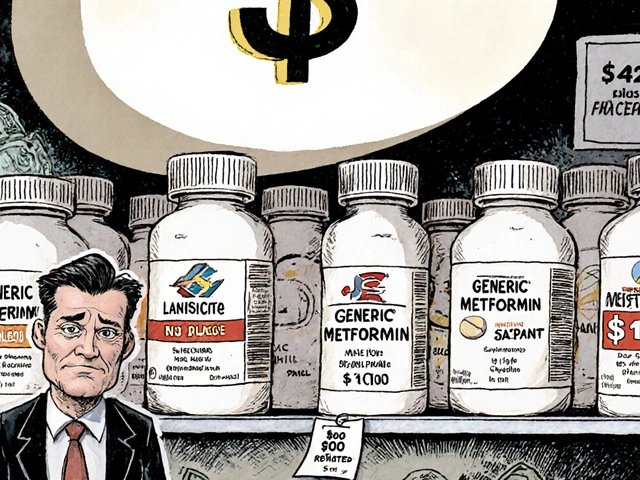

When you’re managing diabetes, insulin isn’t just a medication-it’s a lifeline. But for millions, the price tag makes it feel unattainable. In 2025, the average monthly cost of branded insulin in the U.S. still hovered around $450. That’s why insulin biosimilars aren’t just a medical innovation-they’re a necessity. Unlike generic drugs, which are exact chemical copies, insulin biosimilars are highly similar versions of complex biological products. They don’t match the original molecule atom-for-atom, but they deliver the same clinical results: stable blood sugar, fewer complications, and real cost savings. And while they’ve been used in Europe since 2014, their adoption in the U.S. and other markets has been slower than expected. Here’s what actually matters when considering insulin biosimilars-no fluff, no jargon, just what you need to know.

How Insulin Biosimilars Are Different from Generics

Think of a generic drug like a photocopy. It’s the same chemical formula, same ingredients, same effect. Insulin biosimilars? They’re more like a hand-painted replica of a Van Gogh. The brushstrokes look nearly identical, the colors match, the emotion comes through-but it’s not the same paint, not the same canvas. That’s because insulin is a biological molecule, not a simple chemical. It’s made by living cells, not synthesized in a lab. Even tiny changes in how those cells are grown or processed can affect how the insulin behaves in your body.

This is why biosimilars require far more testing than generics. While a generic metformin just needs to prove it dissolves the same way, a biosimilar insulin must go through dozens of analytical tests, animal studies, and human clinical trials to show it works just like the original-whether it’s Lantus, Humalog, or Levemir. The FDA and EMA don’t just accept "close enough." They demand proof that switching won’t cause spikes, drops, or immune reactions. And in practice, that proof has held up. Studies show no meaningful difference in A1C levels, hypoglycemia rates, or weight gain between biosimilars and their reference products.

Market Examples: Who’s Making Them and Where They’re Used

By 2025, six insulin biosimilars had received approval in the European Union. In the U.S., the landscape is more fragmented but growing fast. Basaglar, a biosimilar to Lantus (insulin glargine), was the first to launch in 2016. Today, it’s one of the most widely used. Semglee, another insulin glargine biosimilar co-marketed by Biocon and Viatris, hit the market in 2021 and quickly became a top choice for insurers because of its price-often under $100 per vial.

Other players include Fiasp (biosimilar to NovoRapid), Abasaglar, and Rezvoglar, which mimics Toujeo. In India and China, where diabetes rates are soaring and public health budgets are tight, local manufacturers like Biocon and BGP Pharma have pushed out low-cost biosimilars priced at 60-70% less than branded versions. In Mumbai, endocrinologists report that nearly half their patients now use biosimilars. In Germany, where healthcare systems prioritize cost efficiency, biosimilar insulin use jumped to 42% of all glargine prescriptions by 2024.

But not all markets are moving at the same pace. In Japan, regulatory caution and strong brand loyalty have kept biosimilar adoption below 15%. In the U.S., despite being the largest market by value-holding nearly 30% of global sales in 2025-adoption has been held back by pharmacy substitution rules. Only 17 states allow pharmacists to switch a patient from branded insulin to a biosimilar without the doctor’s approval. In the other 33, you need a new prescription every time.

Cost Savings: The Real Impact on Patients and Systems

The math is simple: if you’re paying $450 a month for Lantus and switch to Semglee, your bill drops to $90. That’s not a small difference-it’s life-changing. One patient on the American Diabetes Association forum reported his A1C improved from 7.8 to 7.2 after switching, with no side effects and a $360 monthly savings. That’s $4,320 a year back in his pocket.

On a national level, the savings are massive. In the EU, insulin biosimilars cut national spending by an estimated $1.2 billion between 2018 and 2024. In the U.S., CMS increased reimbursement for biosimilars to ASP plus 8% of the originator’s price-a policy that’s incentivized hospitals and clinics to switch. By 2025, the average selling price of insulin biosimilars was $1,840 per unit, roughly 20-30% lower than branded versions. That’s why the global insulin biosimilar market is projected to hit $5.8 billion by 2035, growing at 6.2% annually, while the overall biosimilars market grows at just 13.8%.

But here’s the catch: savings don’t always reach the patient. Some insurers use biosimilars as leverage to raise copays on branded insulins, pushing patients into cheaper options without giving them a real choice. Others require prior authorization, adding delays. The best outcomes happen when savings are passed directly to the consumer-like in Australia, where the Therapeutic Goods Administration added biosimilars to the PBS subsidy list in 2023, cutting out-of-pocket costs to under $30 per script for concession card holders.

Why Adoption Is Still Slow-Even When the Science Is Solid

Here’s the paradox: the data says biosimilars are safe and effective. But in 2025, only 26% of insulin biosimilar products reached more than 25% market share after five years on the market. Compare that to oncology biosimilars, which hit 81% in the same timeframe. Why the gap?

One reason is fear. Patients and even some doctors worry that switching insulin brands could trigger unpredictable lows or highs. A Reddit user shared that after being switched to a biosimilar without warning, he had frequent hypoglycemic episodes and had to go back to his branded insulin. That story sticks. But research shows these cases are rare. A 2025 survey found 68% of patients saw no change in their control after switching. The other 22% needed minor dose tweaks-usually just 5-10% adjustments over a few weeks.

Another barrier is marketing. Sanofi, the maker of Lantus, responded to biosimilar competition by launching an unbranded version of Lantus at the same price as biosimilars. It’s still the same product, just without the brand name. Patients don’t know the difference. Pharmacists can’t substitute. And doctors keep prescribing it because it’s familiar.

Then there’s the regulatory confusion. In Europe, once a biosimilar is approved, it’s considered interchangeable by default. In the U.S., the FDA requires a separate "interchangeable" designation-and only two insulin biosimilars have received it so far. That means even if your doctor prescribes a biosimilar, your pharmacy might not be allowed to substitute it unless the label says "interchangeable." This creates a bureaucratic maze that slows adoption.

What You Need to Know Before Switching

If you’re considering switching to a biosimilar insulin, here’s what to do:

- Ask your doctor if your current insulin has a biosimilar version and whether it’s right for you. Don’t assume your doctor knows-many still think biosimilars are "second-rate."

- Check your insurance. Some plans have tiered pricing that makes biosimilars the cheapest option. Others still favor branded products. Call your insurer and ask for the formulary list.

- Get a clear transition plan. The American Association of Clinical Endocrinologists recommends a 3-6 month monitoring window after switching. Track your fasting glucose, post-meal numbers, and any symptoms of low blood sugar.

- Don’t let the pharmacy switch you without telling you. In most states, they can’t. But if you’re in one of the 17 that allow automatic substitution, ask for written confirmation of what you’re getting.

- Keep your old prescription for 30 days. If you have issues, you can switch back without delay.

Most people transition smoothly. But if you feel different-more tired, more shaky, more frequent lows-don’t ignore it. Talk to your provider. Adjustments are normal. But your safety comes first.

The Future: What’s Coming Next

By 2026, biosimilars for Toujeo and Tresiba-the two latest long-acting insulins-are expected to launch. That will open up even more savings for patients who need ultra-stable, 24-hour coverage. Manufacturers are also investing heavily in smarter delivery systems: pens with Bluetooth tracking, patches with dose reminders, and auto-injectors that sync with apps. Seventy-eight percent of companies are already working on these integrations.

Regulatory harmonization is also improving. The FDA and EMA are working together to align approval standards, which could cut development time by 12-18 months. That means more biosimilars, faster. By 2030, experts predict insulin biosimilars will make up 35-40% of the market in developed countries and 60-65% in emerging ones.

The biggest threat? Not science. Not safety. It’s inertia. The system is built around branded drugs. Prescribing habits, pharmacy workflows, insurance contracts-all favor the status quo. But the data doesn’t lie. Biosimilars work. They save money. They save lives. And if patients, doctors, and policymakers keep pushing, they’ll become the new standard-not the exception.

Are insulin biosimilars safe?

Yes. Over 15 clinical trials and real-world data from millions of patients show insulin biosimilars have no clinically meaningful differences in safety or effectiveness compared to the original products. The FDA and EMA require extensive testing before approval, including studies on immune response, blood sugar control, and hypoglycemia risk. Rare cases of side effects are usually due to dosing adjustments during transition-not the biosimilar itself.

Can I switch from my current insulin to a biosimilar on my own?

No. Never switch without talking to your doctor first. Even though biosimilars are highly similar, your body may need a small dose adjustment. Some people experience temporary changes in blood sugar patterns when switching. Your provider should guide the transition with a monitoring plan, typically over 3-6 months. In some states, pharmacists can substitute biosimilars automatically-but only if the product is FDA-designated as "interchangeable" and your doctor hasn’t prohibited substitution.

Why are insulin biosimilars cheaper than the original?

They’re not cheaper because they’re lower quality-they’re cheaper because the original manufacturer’s patent has expired. Biosimilar companies don’t have to repeat the massive, expensive clinical trials the original maker did. Instead, they prove similarity through targeted studies, which cuts development costs by 50-70%. Those savings get passed on, but not always to the patient. Insurance, pharmacy benefit managers, and pricing structures can absorb some of the discount. The best savings come when the biosimilar is listed as preferred on your insurance formulary.

Do insulin biosimilars work as well for type 1 and type 2 diabetes?

Yes. Clinical trials include both type 1 and type 2 patients, and results show no difference in A1C reduction, hypoglycemia frequency, or weight gain between biosimilars and the reference products. Whether you’re on basal insulin for type 2 or a full basal-bolus regimen for type 1, the biosimilar version behaves the same way in your body. The key is proper dosing and monitoring during the switch.

What’s the difference between "biosimilar" and "interchangeable"?

All interchangeable insulins are biosimilars, but not all biosimilars are interchangeable. A biosimilar means it’s highly similar to the original. An interchangeable designation means the FDA has confirmed you can switch back and forth between the biosimilar and the original without increased risk. Only two insulin biosimilars have this status in the U.S. as of 2025. Interchangeable products can be substituted by pharmacists without doctor approval-where state law allows it. Biosimilars without this designation require a new prescription every time.

Next Steps: What to Do Today

If you’re paying more than $100 a month for insulin, ask your doctor if a biosimilar is an option. Bring up Semglee, Basaglar, or Rezvoglar by name. Check your pharmacy’s formulary. Call your insurer and ask: "Is there a biosimilar version of my insulin on my plan’s preferred list?" If you’re in Australia, confirm it’s on the PBS. If you’re in the U.S., find out if your state allows pharmacist substitution. And if you’ve been hesitant because you’re worried about safety-know this: the science is clear. The only thing standing between you and affordable insulin is the system, not the science.

11 Comments

Insulin biosimilars aren't just cheaper-they're clinically equivalent. The FDA's approval process is brutal: analytical characterization, pharmacokinetics, immunogenicity studies, and head-to-head trials. If it passed, it's safe. Stop treating them like second-tier meds.

It’s not just about molecules-it’s about trust. We’ve been sold fear for decades: "brand = safety," "generic = gamble." But biosimilars? They’re not knockoffs-they’re symphonies played on slightly different instruments, still hitting every note, still moving the soul. And yet, we still treat them like background noise.

Oh wow, another corporate shill piece. "Biosimilars save lives"-sure, until Big Pharma quietly rebrands their own drug as "unbranded Lantus" and charges the same price. This isn't progress-it's a shell game with needles.

If you're scared to switch, that's valid. But don't let fear silence your access. Ask your doctor for the biosimilar. Bring this article. Push back on pharmacy substitutions without consent. You deserve affordable care-and you're not asking for a favor. You're claiming a right.

My dad switched to Basaglar last year after his insulin bill hit $500/month. He was terrified. We tracked his sugars for 6 weeks. No spikes. No crashes. His A1C dropped from 8.1 to 7.4. He saved $380 a month. I wish someone had told us this sooner. You're not risking your health-you're reclaiming it.

Let me just say this: if you're paying more than $100 for insulin, you're being robbed. Biosimilars aren't magic-they're justice. And if your doctor doesn't know about Semglee or Rezvoglar, it's time to find one who does. Your life isn't a negotiation.

Europe’s fine with biosimilars. But we’re America. We pay more for everything. If you want cheap insulin, move to Canada. Or stop complaining and get a job that pays enough to afford the $450.

in india, biosimilars are the only option for most. i use abasaglar. cost: $15/month. no issues. doctors here know it works. why is us so slow?

My sister has type 1 and switched to Semglee last year. She had one week of slight highs-her endo adjusted her dose by 0.5 units. Now she’s stable. No more panic attacks when the bill arrives. If you’re worried, talk to your care team. But don’t let fear keep you from savings that could change your life.

Let’s be real: this whole biosimilar movement is just capitalism repackaging itself as compassion. The original manufacturers didn’t stop making insulin-they just let patents expire and watched the market fracture. Meanwhile, patients are still trapped in a system where your life depends on whether your insurer has a contract with Biocon or Viatris. We’re not fighting for access-we’re fighting for the right to not be exploited by a system that profits off your survival. And until we dismantle the entire pharmaceutical-industrial complex, biosimilars are just a Band-Aid on a gunshot wound.

Wait-so if I’m on Lantus and my pharmacy gives me Basaglar without telling me, is that legal? I thought you needed a new script?